oanda-bot is a python library for automated trading bot with oanda rest api on Python 3.6 and above.

$ pip install oanda-bot

from oanda_bot import Bot

class MyBot(Bot):

def strategy(self):

fast_ma = self.sma(period=5)

slow_ma = self.sma(period=25)

# golden cross

self.sell_exit = self.buy_entry = (fast_ma > slow_ma) & (

fast_ma.shift() <= slow_ma.shift()

)

# dead cross

self.buy_exit = self.sell_entry = (fast_ma < slow_ma) & (

fast_ma.shift() >= slow_ma.shift()

)

MyBot(

account_id='<your practice account id>',

access_token='<your practice access token>',

).run()from oanda_bot import Bot

class MyBot(Bot):

def strategy(self):

fast_ma = self.sma(period=5)

slow_ma = self.sma(period=25)

# golden cross

self.sell_exit = self.buy_entry = (fast_ma > slow_ma) & (

fast_ma.shift() <= slow_ma.shift()

)

# dead cross

self.buy_exit = self.sell_entry = (fast_ma < slow_ma) & (

fast_ma.shift() >= slow_ma.shift()

)

MyBot(

account_id='<your practice account id>',

access_token='<your practice access token>',

).backtest()from oanda_bot import Bot

Bot(

account_id='<your practice account id>',

access_token='<your practice access token>',

).report()from oanda_bot import Bot

class MyBot(Bot):

def strategy(self):

rsi = self.rsi(period=10)

ema = self.ema(period=20)

lower = ema - (ema * 0.001)

upper = ema + (ema * 0.001)

self.buy_entry = (rsi < 30) & (self.df.C < lower)

self.sell_entry = (rsi > 70) & (self.df.C > upper)

self.sell_exit = ema > self.df.C

self.buy_exit = ema < self.df.C

self.units = 1000 # currency unit (default=10000)

self.take_profit = 50 # take profit pips (default=0 take profit none)

self.stop_loss = 20 # stop loss pips (default=0 stop loss none)

MyBot(

account_id='<your practice account id>',

access_token='<your practice access token>',

# trading environment (default=practice)

environment='practice',

# trading currency (default=EUR_USD)

instrument='USD_JPY',

# 1 minute candlesticks (default=D)

granularity='M1',

# trading time (default=Bot.SUMMER_TIME)

trading_time=Bot.WINTER_TIME,

# Slack notification when an error occurs

slack_webhook_url='<your slack webhook url>',

# Line notification when an error occurs

line_notify_token='<your line notify token>',

# Discord notification when an error occurs

discord_webhook_url='<your discord webhook url>',

).run()from oanda_bot import Bot

class MyBot(Bot):

def strategy(self):

rsi = self.rsi(period=10)

ema = self.ema(period=20)

lower = ema - (ema * 0.001)

upper = ema + (ema * 0.001)

self.buy_entry = (rsi < 30) & (self.df.C < lower)

self.sell_entry = (rsi > 70) & (self.df.C > upper)

self.sell_exit = ema > self.df.C

self.buy_exit = ema < self.df.C

self.units = 1000 # currency unit (default=10000)

self.take_profit = 50 # take profit pips (default=0 take profit none)

self.stop_loss = 20 # stop loss pips (default=0 stop loss none)

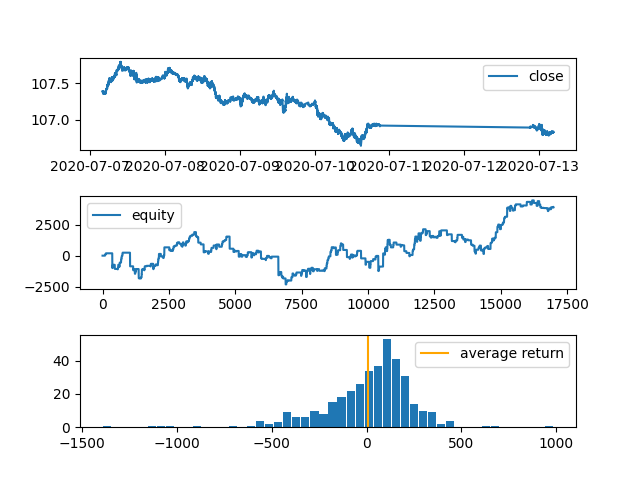

MyBot(

account_id='<your practice account id>',

access_token='<your practice access token>',

instrument='USD_JPY',

granularity='S15', # 15 second candlestick

).backtest(from_date="2020-7-7", to_date="2020-7-13", filename="backtest.png")total profit 3910.000

total trades 374.000

win rate 59.091

profit factor 1.115

maximum drawdown 4220.000

recovery factor 0.927

riskreward ratio 0.717

sharpe ratio 0.039

average return 9.787

stop loss 0.000

take profit 0.000from oanda_bot import Bot

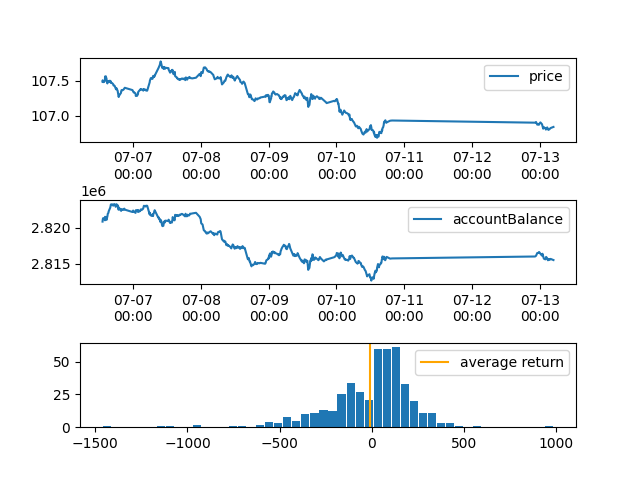

Bot(

account_id='<your practice account id>',

access_token='<your practice access token>',

instrument='USD_JPY',

granularity='S15', # 15 second candlestick

).report(filename="report.png", days=-7) # from 7 days ago to nowtotal profit -4960.000

total trades 447.000

win rate 59.284

profit factor -0.887

maximum drawdown 10541.637

recovery factor -0.471

riskreward ratio -0.609

sharpe ratio -0.043

average return -10.319from oanda_bot import Bot

class MyBot(Bot):

def atr(self, *, period: int = 14, price: str = "C"):

a = (self.df.H - self.df.L).abs()

b = (self.df.H - self.df[price].shift()).abs()

c = (self.df.L - self.df[price].shift()).abs()

df = pd.concat([a, b, c], axis=1).max(axis=1)

return df.ewm(span=period).mean()

def strategy(self):

rsi = self.rsi(period=10)

ema = self.ema(period=20)

atr = self.atr(period=20)

lower = ema - atr

upper = ema + atr

self.buy_entry = (rsi < 30) & (self.df.C < lower)

self.sell_entry = (rsi > 70) & (self.df.C > upper)

self.sell_exit = ema > self.df.C

self.buy_exit = ema < self.df.C

self.units = 1000

MyBot(

account_id='<your live account id>',

access_token='<your live access token>',

environment='live',

instrument='EUR_GBP',

granularity='H12', # 12 hour candlesticks

trading_time=Bot.WINTER_TIME,

slack_webhook_url='<your slack webhook url>',

).run()- Simple Moving Average 'sma'

- Exponential Moving Average 'ema'

- Moving Average Convergence Divergence 'macd'

- Relative Strenght Index 'rsi'

- Bollinger Bands 'bbands'

- Market Momentum 'mom'

- Stochastic Oscillator 'stoch'

- Awesome Oscillator 'ao'

For help getting started with OANDA REST API, view our online documentation.

- Fork it

- Create your feature branch (

git checkout -b my-new-feature) - Commit your changes (

git commit -am 'Add some feature') - Push to the branch (

git push origin my-new-feature) - Create new Pull Request