jquants-pairs-trading is a python library for backtest with japanese stock pairs trading using kalman filter, J-Quants on Python 3.8 and above.

$ pip install jquants-pairs-trading

from jquants_pairs_trading import JquantsPairsTrading

import pprint

jpt = JquantsPairsTrading(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

)

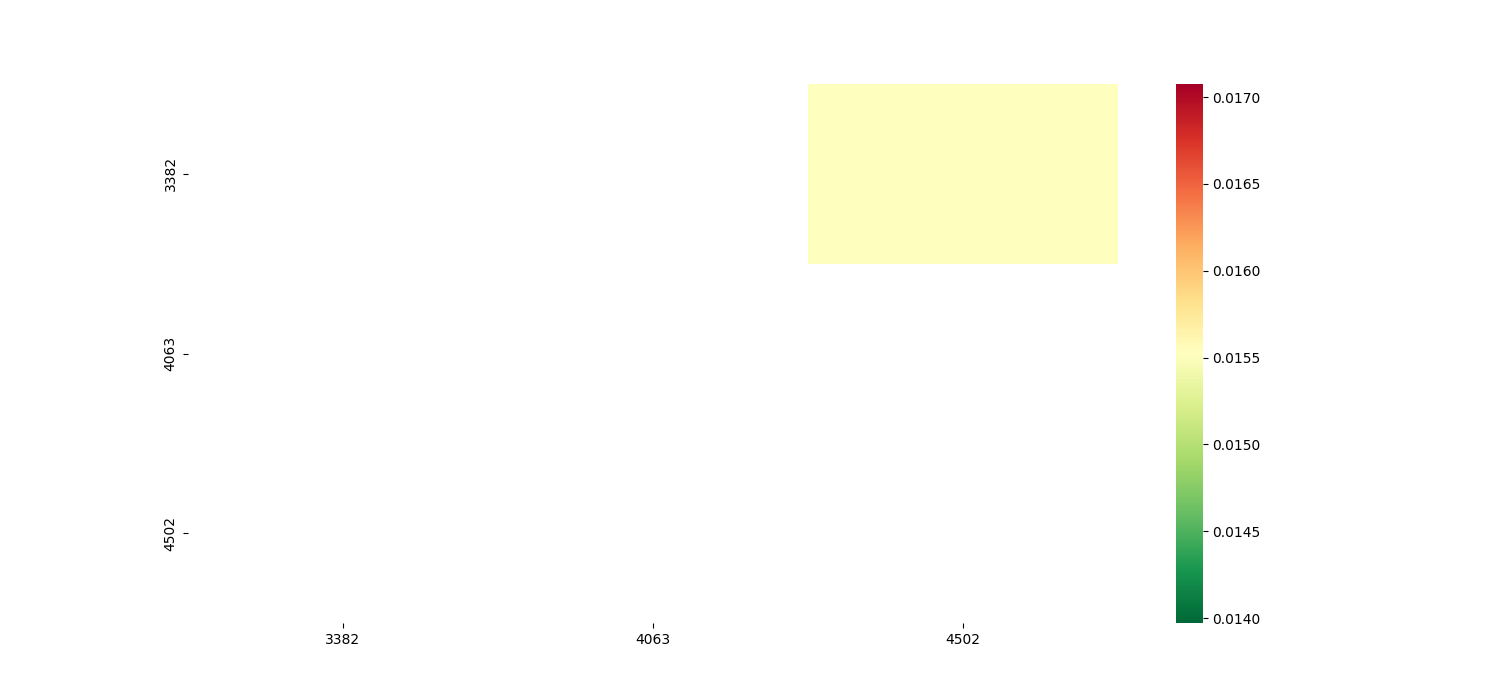

pprint.pprint(jpt.find_pairs([3382, 4063, 4502]))[('3382', '4502')]from jquants_pairs_trading import JquantsPairsTrading

import pprint

jpt = JquantsPairsTrading(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

)

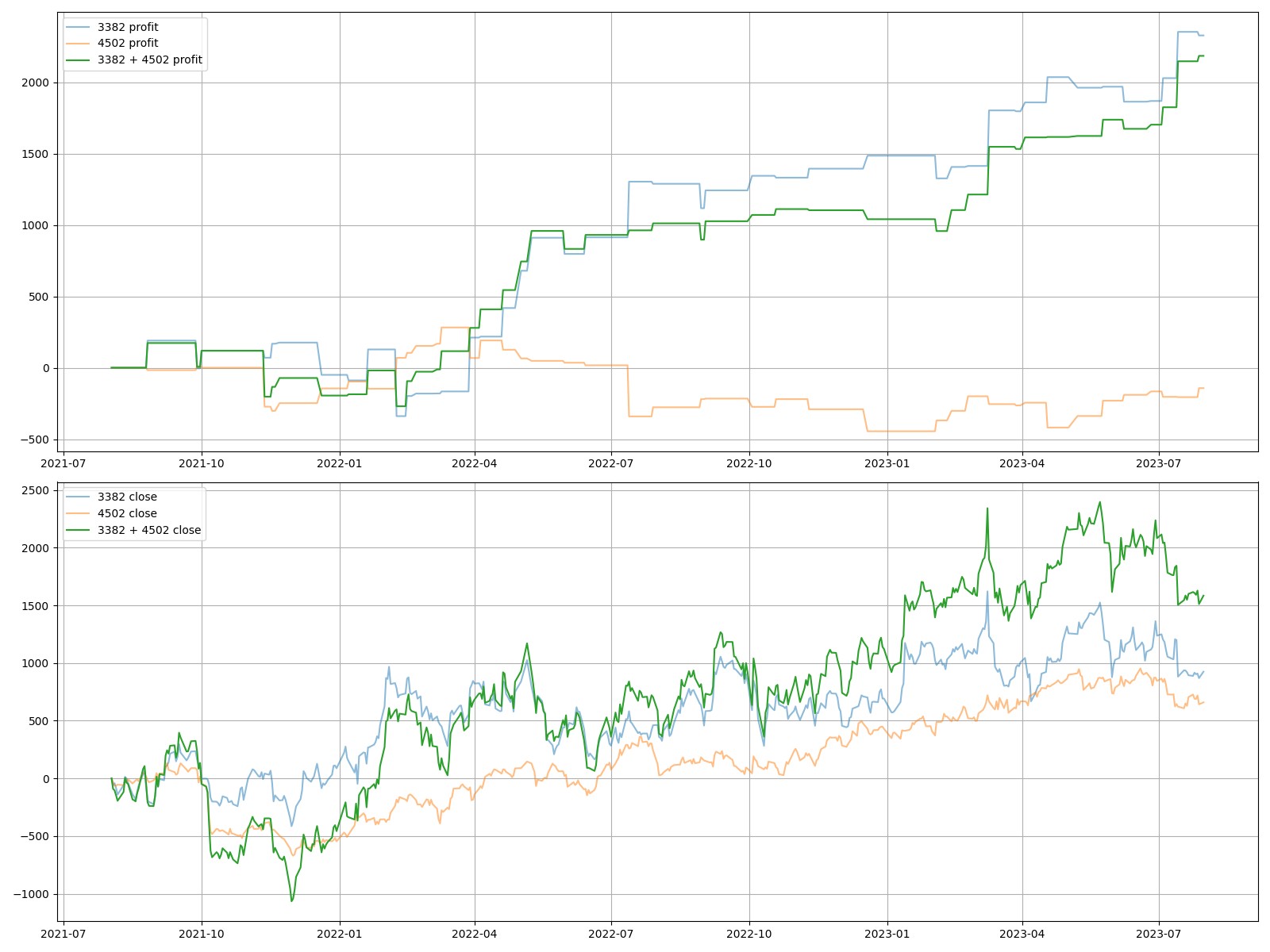

pprint.pprint(jpt.backtest((3382, 4502))){'cointegration': '0.016',

'correlation': '0.814',

'maximum_drawdown': '443.000',

'profit_factor': '1.654',

'riskreward_ratio': '1.081',

'sharpe_ratio': '0.183',

'total_profit': '2184.000',

'total_trades': '86.000',

'win_rate': '0.605'}from jquants_pairs_trading import JquantsPairsTrading

import pprint

jpt = JquantsPairsTrading(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

)

pprint.pprint(jpt.latest_signal((6954, 6981))){'6954 buy': True,

'6954 close': '4348.000',

'6954 long': False,

'6954 sell': False,

'6954 short': False,

'6981 buy': False,

'6981 close': '2775.000',

'6981 long': False,

'6981 sell': True,

'6981 short': False,

'date': '2023-07-31'}from jquants_pairs_trading import JquantsPairsTrading

import pprint

jpt = JquantsPairsTrading(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

window=1,

transition_covariance=0.01,

pvalues=0.05,

zscore=0.5,

)

pprint.pprint(jpt.find_pairs([3382, 4063, 4502]))

pprint.pprint(jpt.backtest((3382, 4502)))

pprint.pprint(jpt.latest_signal((6954, 6981)))For help getting started with J-Quants, view our online documentation.